Market Intelligence Data

Dodge Momentum Index Down in Nov.

Buildings & Infrastructure Planning Declines

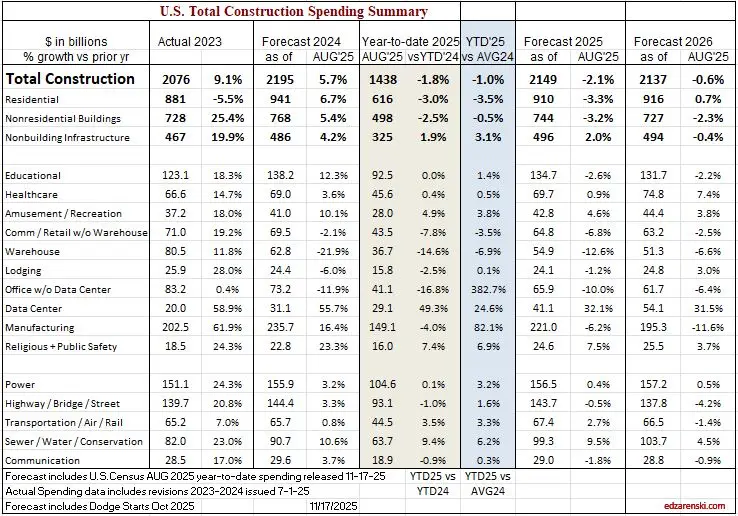

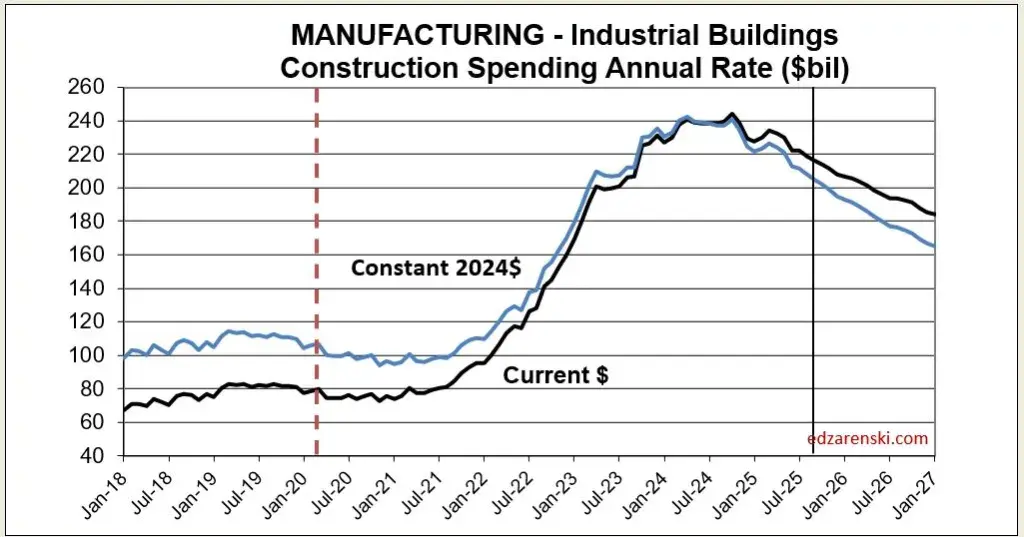

The decline in Manufacturing construction spending is due to having passed the peak in the scheduled project timelines for the large volume of mega-projects that started in 2021-22-23-24. (I wrote about it in more detail in Nov’24 in the article linked.) Peak spending is typically just past the midpoint of project construction. From Apr 2024 to Nov 2024, Mnfg spending averaged $240bil., the highest rate of spending on record. In 2025 it started the year at a rate of $$230bil but will end the year at $210bil. By the end of 2026 the rate of spending drops to $190bil.

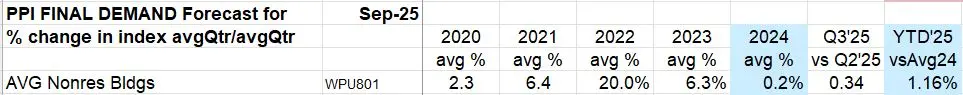

We will wait a little longer before we see any meaningful changes in construction materials input costs. September data (released 11-26-25) reported here. Also remember, PPI does not track imports, only domestic producers. Therefore, any implied increase in PPI being related to tariffs would be a domestic reaction to an import tariff. We can expect that.

INPUTS thru Sept up ~2% from avg2024. Final Demand for Nonres Bldgs is up 1.2% ytd vs avg 2024. However, Oct is the revision month for Q3 Final Demand data, so Final Demand data not finalized for Q3.

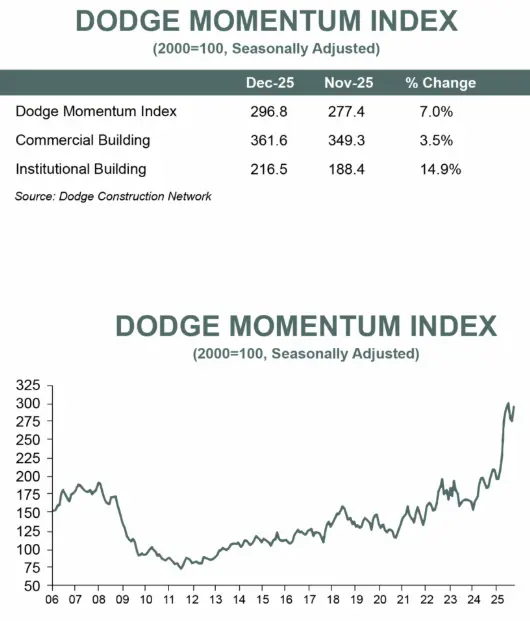

BOSTON, MA – January 8, 2026 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network grew 7.0% in December to 296.8 (2000=100) from the upwardly revised November reading of 277.4. Over the month, commercial planning improved 3.5% and institutional planning increased by 14.9%. In 2025, the DMI was up 37% from the average reading in 2024. The commercial portion was up 35% and the institutional portion was up 43% over the same period.

“Nonresidential construction starts (excluding manufacturing and transportation) are projected to accelerate in 2027 alongside sustained planning momentum in data center, healthcare and recreational building construction throughout 2025,” stated Sarah Martin, Associate Director of Forecasting at Dodge Construction Network. “Inflationary pressures will further support nominal activity levels, even as economic risks remain elevated. Notably, projects moved through the planning process marginally quicker in 25-Q4 (16 months vs. 18 months in 25-Q3), offering a modest boost to our near-term outlook.”

On the commercial side, planning momentum accelerated most strongly for warehouses, office buildings and data centers. Within institutional planning, education and recreational building activity showed the strongest growth, while planning for public buildings pulled back after elevated activity in mid-2025. Year-over-year, the DMI was up 50% when compared to December 2024. The commercial segment was up 45% (+30% when data centers are removed) and the institutional segment was up 60% over the same period.

A total of 34 projects valued at $100 million or more entered planning throughout December. The largest commercial projects included four phases of the Google Data Center Campus in Summit, Oklahoma – each valued at $500 million dollars. Additionally, Phases 2 and 3 of the Central Park Data Information Processing Center in Loxahatchee, Florida entered planning – valued at $473 million and $431 million respectively. The largest institutional projects to enter planning were the $450 million Atrium Health Hospital in Fort Mill, South Carolina, the $295 million St. Joseph Hospital Tower (Phase 2 Expansion) in Stockton, California, and the $182 million SunRay Casino and Park in Clovis, New Mexico.

The DMI is a monthly measure based on the three-month moving value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year to 18 months.

NEW ENGLAND - November 25, 2025. Ed Zarenski (www.edzarenski.com) reports

After some delayed data released recently, we now have August Construction Spending and Sept Jobs.

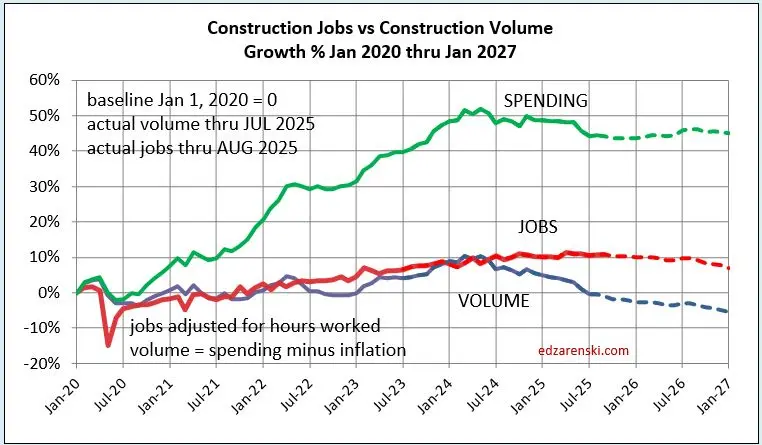

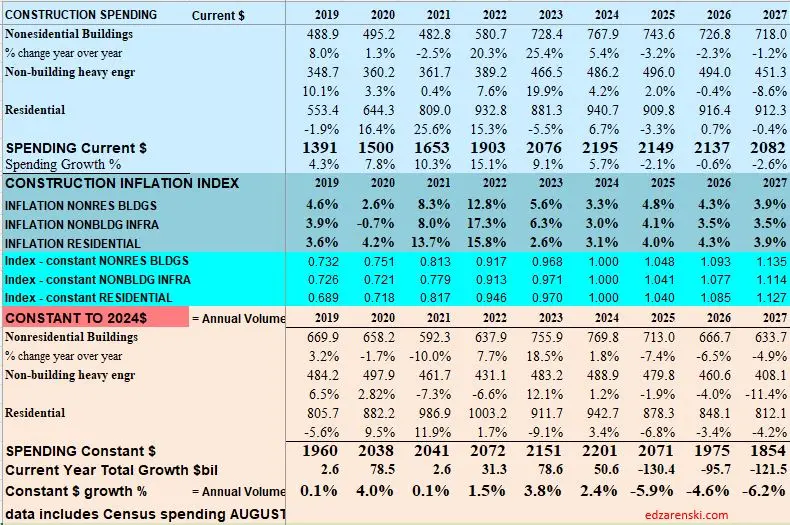

In the past 12mo, Rsdn construction jobs fell 46k (-1.4%). Nonres Bldgs jobs increased 59k (+1.6%) and Nonbldg jobs increased 24k (+2.1%). Rsdn spending is down 5% (-$39bil) Nonres Bldgs is down 3.4% (-$25bil) Nonbldg is up 3.1% (+$15bil) Expect total spending in 2025 down 2.1%, jobs UP 1%

Construction Spending Forecast Total spending varies less than 1% from current through 2026 Jobs YTD up 16k. Only times job growth that slow was 2020 or recessions. 2011 through 2024, even with losses in 2020, avg jobs growth was 200k/yr. Don’t expect job openings (see JOLTS) in near future.

Environment for construction jobs looking difficult. Constant $ spending in 2026 is down just less than 1%. But Volume of work (spending minus inflation) available is down just over 4% and is declining all through 2026. Biggest declines by far, Manufacturing and SF Rsdn.

My forecast has not changed much overall in the last few months. Residential has gained in revisions added to June and July and Aug posted a very strong 1.3% gain.

Project Highlights

Don Sherman Joins TeknoGRID Board

TeknoGRID is proud to announce that Donald Gary (D.G.) Sherman has joined its newly formed Broadband Advisory Board.

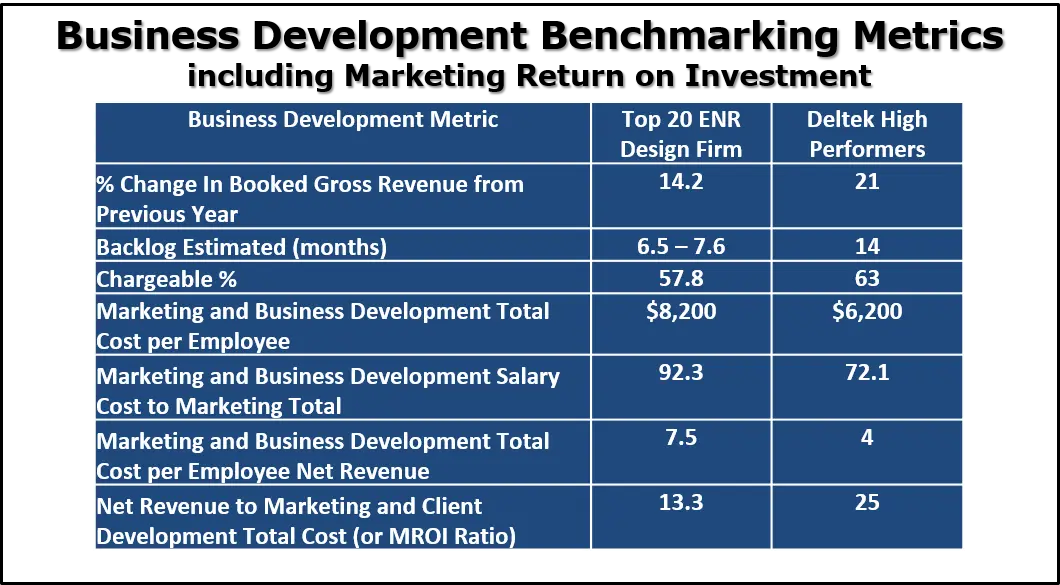

Are you and your leadership prepared for a repeat of the 2008-2011 AEC market shifts?

Are double digit growth, excellent profitability, strong utilization and high win rates sustainable? Let us help you proactively control your whether there is a boom or a bear market for your services.